Gesvalt Facilitates PPA Transaction for Multinational Nemak

06 February, 2024

By Gesvalt (Spain)

The following case study highlights our member Gesvalt’s pivotal role in conducting a Purchase Price Allocation (PPA) related to the acquisition of Turkish company Cevher, that boosted the core business and global presence of high-tech component manufacturer Nemak.

Introduction:

The company Nemak relied on Gesvalt’s capabilities to be the financial advisors for the development of a PPA report in relation to the acquisition of Turkish company Cevher.

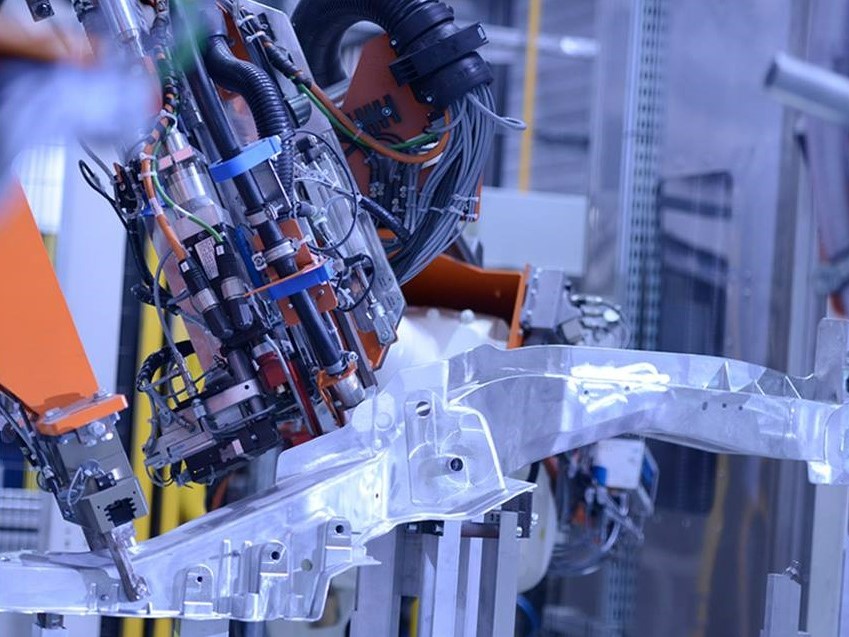

With the acquisition of Cevher, a company with a proven track record in the supply to major European automotive manufacturers, Nemak was able to further increase its global presence as a manufacturer of innovative lightweighting solutions for the global automotive industry. The success of this strategic transaction not only added value but also propelled the company’s growth initiatives in Europe.

Challenges:

Nemak engaged experts at Gesvalt to conduct a Purchase Price Allocation (PPA) exercise in compliance with International Financial Reporting Standard 3, Business Combinations (“IFRS 3”) in relation to the acquisition of Cevher.

The Mexican company needed the valuation of their tangible, intangible and other assets and/or liabilities acquired in order to arrive at a final agreement on the acquisition of the Turkish company Cevher, a supplier of complex aluminium castings.

In the transactional market, Purchase Price Allocation or PPA is an accounting requirement under international financial reporting standards (IFRS) aimed at identifying all assets and liabilities in a merger or acquisition transaction and assigning a market value to them.

Requirements for Report Preparation:

It is necessary to be advised by an approved independent advisor, a requirement that Gesvalt meets. In addition, our valuation experience for the industrial sector and large transactions is a key factor to be considered.

Gesvalt’s expert team covered the entire valuation process for tangible, intangible, and financial assets, ensuring effective coordination and communication with supervisory audit teams. In conclusion, Gesvalt’s work not only brought transparency but also facilitated the comparison of financial information for investors and users.

Nemak, a subsidiary of Grupo Alfa, currently employs more than 22,000 people in 38 facilities worldwide.